Multi-Asset Strategies

Sophisticated solutions for mixed portfolios lead to investment success

The intervals between the crises we experience are increasingly short these days and the capital markets are thus rather volatile. It is therefore important to weatherproof our investments and guide them calmly through stormy waters. At the same time, capital market players need to stay on top of a vast amount of information flooding in daily. Investors need to make sure their decisions are not guided by short-term moods but instead take the greater fundamental picture into account and are focused on long-term investment goals. Investment success depends less on short-term market timing and more on the strategic orientation of the portfolio.

In a first step, we help you define a long-term investment strategy and, based on that strategy, we create a portfolio that is broadly diversified across the asset classes and tailored to your individual risk/return profile. In addition to traditional asset classes, tangible assets such as real estate or gold can also be taken into account. We keep a close eye on opportunity and risk management, and we actively manage the portfolio based on its fundamental strategic focus. We pursue a disciplined and well-established investment approach based on perfectly balanced indicator sets. The systematic recording and empirically based evaluation of fundamental and technical factors serves as a compass to guide us through the markets on a daily basis. This enables us to make courageous investment decisions – even outside the mainstream.

- We pursue a fundamental investment philosophy. We form our market opinions on based on economically sound analyses.

- We are proactive and have the courage to make decisions that go against the consensus view.

- We think strategically. Finding the most suitable long-term portfolio structure is more important for the success of the investment strategy than short-term decisions. For example, having high strategic equity exposure when share prices rise makes a greater contribution to performance than good market timing does when equity allocation is too low. Thus, it is the "how much" that determines investment success rather than the "when".

- Our teams are organized along work lines with clearly assigned responsibilities. This specialist approach enables the respective teams to focus on their strengths. The asset allocation team bears overall responsibility for value development and performance and manages the quotas of the asset classes. At selection level, we draw on the individual stock/bond pickers' expertise in portfolio management of equities and bonds.

- We invest sustainably. In addition to compliance with exclusion criteria, we believe sustainability factors are relevant to performance and thus integrate them into our individual stock and bond analysis.

Metzler's corporate values form a solid foundation

Our investment philosophy for managing multi-asset portfolios is rooted in the corporate values of Metzler Bank: entrepreneurial spirit, independence and humanity. We are committed decision-makers with the courage to take entrepreneurial action. We carry out our own research and make independent decisions seperate from the mainstream. In addition, we place people in charge of the investment process who have fiduciary responsibility for the portfolio. The unique combination of our corporate values and a disciplined investment process lays the foundation for sustained, consistent investment success.

Entrepreneurship

We strengthen our competitive position by constantly and carefully reviewing and developing our investment process and are among the pioneers when it comes to sustainability criteria.

Independence

We offer investment solutions off the beaten track by focusing on our own research.

Humanity

We promote individual strengths within a team approach and can thus contribute significantly to your investment success.

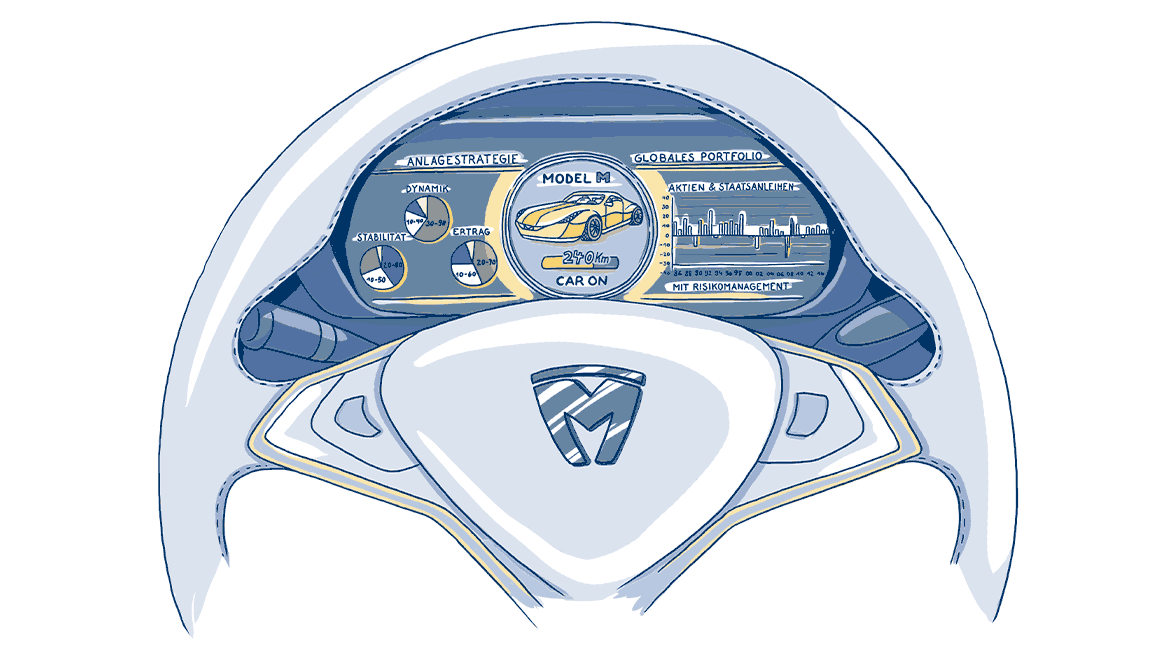

The set screws of our investment process

Driving force of the investment strategy

A broadly diversified strategic asset allocation is the driving force behind our investment process and the long-term performance driver of the strategy. It consists of allocating assets to various asset classes for the long term. In order to lay the foundation for long-term investment success, we derive a strategic asset allocation (SAA) strategy that best suits your individual investment preferences and risk specifications.

For deriving the strategic asset allocation strategy, we assume a stable long-term relationship between return and risk. Investors are to be be rewarded for taking more risk with higher returns in the long term. The aim is to "optimally" allocate portfolio risk, taking into account the correlation characteristics of the asset classes equities, government and corporate bonds, and alternative investments.

It is important to spread the risk broadly across asset classes and regions in order to use various risk premiums (such as equity risk premiums, maturity premiums and credit risk premiums) as a source of return. This is intended to stabilize portfolio income and diversify portfolio risk over the long term.

Strategic asset allocation is essential to achieving long-term investment goals, as strategic market allocation in the respective asset classes is superior to market timing. For example, having high strategic equity allocation delivers a higher performance contribution when share prices rise than good market timing does when equity allocation is too low.

Tactical asset allocation dominates the aerodynamics of the portfolio

However, short-term market opportunities can remain untapped if the company focuses exclusively on long-term strategic asset allocation. We therefore use tactical asset allocation (TAA) to exploit short-term market opportunities in order to increase the long-term return on the portfolio. This enables us to adapt quickly to changing general market situations.

Our assessments and tactical positioning are based on specially developed indicators that we use to analyze daily market data and numerous cyclical- and counter-cyclical factors. Depending on the results of our analysis, we can be decide to deviate from strategic asset allocation, thereby opening up opportunities for the portfolio to achieve additional tactical returns.

A braking mechanism in times of assistant in extreme loss

This braking mechanism is a specially developed risk management system and a fixed and integral part of our investment process. It is suitable for market phases when short-term risks arising from extreme events overshadow long-term stable relationships between risk and return. The aim of risk management is to effectively limit losses when stock markets correct by more than 10 %. Since our risk management only takes effect in rare cases of extreme loss risks, the associated strategy costs are limited.

Risk management intervenes in strategic asset allocation (SAA) in gradual steps. Thus, SAA equity exposure can be systematically and gradually reduced without completely eliminating equity exposure. When the situation on the markets calms down again, hedges are systematically and gradually reduced.

We invest sustainably

The integration of sustainability aspects is an indispensable part of our investment philosophy and represents a clear commitment to developing concepts that are sustainable in the long term. In our investment process for multi-asset strategies, we take into account how companies implement environmental, social and governance (ESG) aspects. By integrating ESG aspects, we aim to enhance the risk-return profile of the funds.

Since 2021, our multi-asset funds have been classified in accordance with Article 8 of the EU Disclosure Regulation, thus underpinning our sustainable investment approach. You, the investor, can rest assured that sustainability criteria are sufficiently taken into account in portfolio and risk management. Furthermore, our sustainability approaches and criteria comply with the heightened transparency requirements for funds in line with Article 8.

Sustainability aspects are taken into account for both mutual funds and special AIFs. With special AIFs, you define the client-specific sustainability criteria that are implemented in the selection and allocation process.

Our ESG reporting system provides additional transparency and covers all significant sustainability aspects. It includes data and ratings from several ESG research partners as well as an evaluation of engagement.

Strategic asset allocation is based on your individual needs

The strategies in our basic models differ in three fundamental areas: defensive, return and dynamics. We can adapt our strategies upon request to suit your individual investment guidelines.

We link the expected return for the entire portfolio to the money market interest rate (3-month Euribor) because the total return achievable depends on the general interest rate level. For risk management purposes, we use a strategy-specific "loss budget" as an internal control parameter that only serves to control strategy risk and is not to be confused with a "hard" minimum portfolio value.

Implementation in the form of special and mutual funds

Based on our fundamental multi-asset strategies, we offer you the following three mutual funds in institutional asset classes, depending on your individual investment goals:

Metzler Multi Asset Defensive B

More information, sales prospectuses and KIIDs for the funds can be found under Fund Prices & Documents.

Deutsch

Deutsch English

English